The anticipated inking of the IMF agreement in early 1Q 202 is likely to strengthen the Sri Lanka rupee in the immediate near term following the ongoing debt restructuring negotiations, states CT CLSA Securities in its monthly report.

“Interest Rates too are likely to stabilise and reduce, driven by near-term monetary policy directives.”

The report stated that the GDP forecast is expected to contract to -9.3% YoY for 2022 year end and -2.1% YoY for 2023 year end and subsequently expected to expand by +3.5% YoY by 2024 year end.

On January 25, Policy interest rates were maintained by the CBSL during its first monetary policy review for the year, with the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) maintained at 14.5% and 15.5%, along with Statutory Reserve Ratio (SRR) at 4% considering recent and expected developments and projections on the domestic and global macroeconomic fronts.

The Board noted that the maintenance of a tight monetary policy stance is imperative to ensure that monetary conditions remain sufficiently tight to rein in inflationary pressures. “Such policies, together with the tight fiscal policy, are expected to adjust inflation expectations downward, enabling the Central Bank to bring inflation rates towards the desired levels by the end of 2023, thereby restoring economic and price stability over the medium term.”

“The deceleration in inflation is expected to continue, supported by subdued aggregate demand pressures, expected improvements in domestic supply conditions, global commodity prices, and the timely pass-through of such reductions to domestic prices.

The Colombo Bourse closed positive in January, with the benchmark All Share Price Index (ASPI) gaining +4.4% MoM to 8,865 points (an increase of 375 index points MoM).

The more liquid S&P SL20 index increased +4.9% MoM to 2,765 points (an increase of 129 index points).

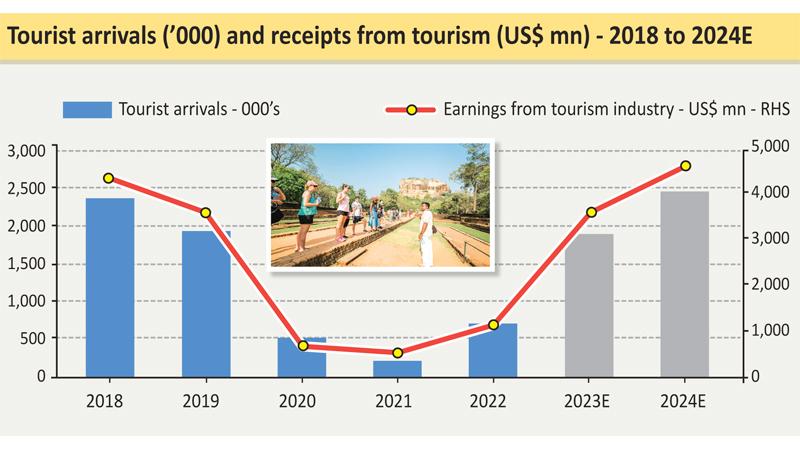

Tourist arrivals to Sri Lanka (SL) improved by +12% MoM to 102,545 arrivals for January 2023 (vs. 91,961 arrivals in December 2022), primarily due to resumption of international airlines operations to SL coupled with removed travel barriers from key source markets and resurgence in cruise ship operations in the industry.

We expect our export earnings for 2023E to reach US$14,520mn (+9% YoY) and US$15,739mn (+8% YoY) in 2024E.

“While we broadly maintain our import expenditure forecast at US$18,586mn (+3% YoY) for 2023E and US$19,861mn (7% YoY) for 2024E.” (SS)

The report also recalled that The Colombo Bourse closed positive in January, with the benchmark All Share Price Index (ASPI) gaining +4.4% MoM to 8,865 points (an increase of 375 index points MoM).

Meanwhile, the more liquid S&P SL20 index increased +4.9% MoM to 2,765 points (an increase of 129 index points).