WASHINGTON: Global growth is slowing sharply in the face of elevated inflation, higher interest rates, reduced investment, and disruptions caused by Russia’s invasion of Ukraine, according to the World Bank’s latest Global Economic Prospects report.

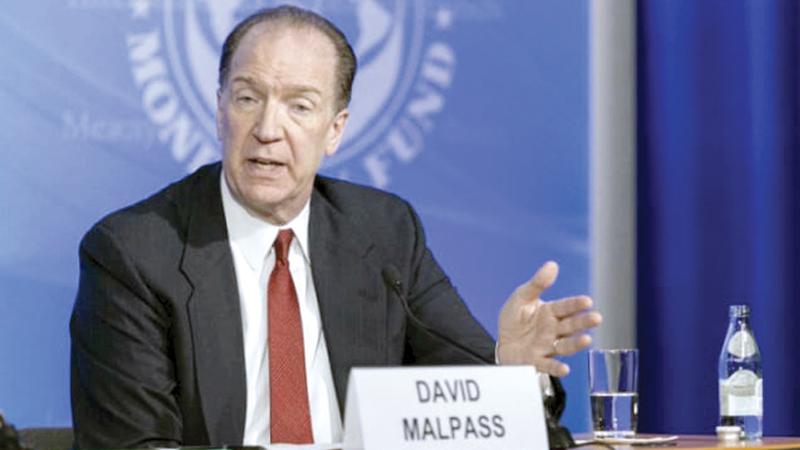

“The crisis facing development is intensifying as the global growth outlook deteriorates,” said World Bank Group President David Malpass.

“Emerging and developing countries are facing a multi-year period of slow growth driven by heavy debt burdens and weak investment as global capital is absorbed by advanced economies faced with extremely high government debt levels and rising interest rates.”

Given fragile economic conditions, any new adverse development — such as higher-than-expected inflation, abrupt rises in interest rates to contain it, a resurgence of the Covid-19 pandemic, or escalating geopolitical tensions — could push the global economy into recession.

This would mark the first time in over 80 years that two global recessions have occurred within the same decade.

The global economy is projected to grow by 1.7% in 2023 and 2.7% in 2024. The sharp downturn in growth is expected to be widespread, with forecasts this year revised down for 95% of advanced economies and nearly 70% of emerging market and developing economies.

Over the next two years, per-capita income growth in emerging markets and developing economies is projected to average 2.8% — a full percentage point lower than the 2010-2019 average. In Sub-Saharan Africa — which accounts for about 60% of the world’s extreme poor — growth in per capita income over 2023-24 is expected to average only 1.2%, a rate that could cause poverty rates to rise, not fall.

The World Bank states that the economies of the South Asia region (SAR) including Sri Lanka too continue to be adversely affected by shocks emanating from the Russian Federation’s invasion of Ukraine, including higher food and energy prices, and by the tightening of global financial conditions as central banks in the region and elsewhere act to fight high inflation.