Thrift is a virtue that is fast disappearing from today’s society. People hardly save a few rupees at a time, with the intention of banking the accumulated money. The inclination is to spend the left over hundred or two hundred rupees, rather than make the effort to deposit it. One reason for this is that costs and time taken to travel to a bank does not incentivize people.

If there is a system to deposit left over money in hand, on the go, more people will be encouraged to save the little amounts of money in hand. This is exactly what Sunil Jayasinghe, the developer of ‘EasyDeposit’ savings mechanism aimed at. “EasyDeposit is a system where people can deposit small amounts of money in banks by entering the code from a scratch card, similar to reloading mobile phones. This allows one to deposit money to any bank,” said Jayasinghe.

How the concept dawned

Jayasinghe, a resident of Thalgaswala, Mapalagama in the Galle District, graduated from the Ruhunu University in 1995, with a Bachelor of Arts degree specializing in Pali, and is a Piriven teacher at Sadaham Sevana Mulika Pirivena in Porawagama, Elpitiya.

Jayasinghe, a resident of Thalgaswala, Mapalagama in the Galle District, graduated from the Ruhunu University in 1995, with a Bachelor of Arts degree specializing in Pali, and is a Piriven teacher at Sadaham Sevana Mulika Pirivena in Porawagama, Elpitiya.

According to him, the idea for the development of an easy deposit system sparked due to a random incident.

“My older daughter was studying for the GCE Advanced Level examination at the time and she used to save the leftover pocket money at home. I sometimes borrow small amounts from her when short of cash. One day, I borrowed money from her and she asked whether I can directly deposit the money to a bank. I said no, since I was on my way to work,” he recalled.

Then, his daughter queried if he (Jayasinghe) had time to top up his mobile, why not for depositing money. It was deliberating on this question that resulted in the development of EasyDeposit back in 2011.

How it works

Speaking of the mechanism through which this can operate, Jayasinghe said that the scratch cards should be distributed to shops by the banks, with a commission for selling them, same as the mobile phone recharge cards.

Any individual can deposit money in banks by typing the QR code in the scratch card and sending it via a message to the bank. “This only needs a bank account and a mobile phone. The mobile phone need not be a smart phone since messaging can be via SMS, USSD or an app,” he said.

Jayasinghe said that through LankaPay, money can be sent to any bank by denoting each bank via a specific code. Alternatively, banks can issue their own set of cards, similar to the mobile service providers.

The app is targeted at grassroots level people in rural areas, with an affinity for saving.

Jayasinghe has obtained Intellectual Property Rights (No. 16786) from the Intellectual Property Office (IPO) of Sri Lanka for the remote cash deposit system developed by him.

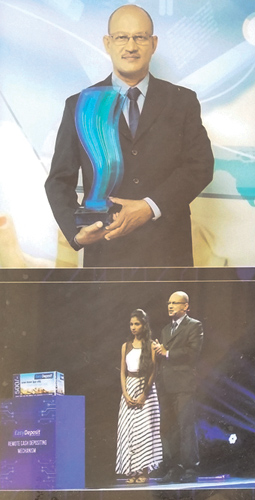

He also won the second place in the open category of the Sahasak Nimayum exhibition organised by the Sri Lanka Inventors Commission, in 2014 and was also judged the winner of the inaugural Kotiyak Vatina Adahasak (KVA), the first reality TV show on New Commercial Innovation, sponsored by Mobitel, which was telecast on a private TV channel last year.

He said that KVA required the competitors to develop business plans, marketing plans, at different levels, and they were allowed financial aid for the project.

Banks hesitant

However, there is one major drawback in going forward with Jayasinghe’s novel idea. The commercial banks in the country are hesitant to collaborate with the project.

“I discussed this concept with several banks, they admitted this is a valuable project, but none of them went any further. When I asked the reasons, none of them gave any,” he said. However, Jayasinghe said that the Presidential Secretariat and LankaClear had agreed to collaborate.

He has prepared a financial forecast, indicating the costs for the banks and a formula via which the banks can calculate the profits and he awaits an opportunity to collaborate with a bank.

He said that the main costs incurred by the banks in using this system will be for card printing, card distribution, and commission for shops and payment for him.

According to Fayaz Hudah, Judge on KVA Season 1 and Founder of Spiralation, the first technology accelerator in Sri Lanka, given the simplicity of the technology solution itself and the significant challenge in executing,he remembers the judges being concerned of this innovation becoming a commercial success.

However, Hudah says that he pushed for the project from the start because it has a huge market potential.

“Although I am involved in many startup events and competitions, I choose to work with a very few.

I like entrepreneurs who have the capacity to persevere despite the odds. Therefore, I am happy to be a part of the company helping to bring this product to market,” he said.

Officials at KVA say that saving money in a ‘piggy bank’, expecting to take it to the bank someday, actually adds costs to the system, since money is taken out of circulation. There is a belief that low domestic savings rates are symptomatic of this challenge, which requires a novel solution which is unique to banking. EasyDeposit can be this long awaited solution.

The objective of EasyDeposit is to convert unbanked money into convenient, remote cash deposits system available 24x7, enabling the bank’s access to cheap funds.

This enables customers to conveniently deposit even a minimal amount of cash, facilitates money circulation at the national level and contributes towards converting unbanked money into savings.

Officials at KVA said that the greatest impact on the domestic savings indicator can be made not by large value savings, but by small savings by many. This can be well achieved by making saving easy, spontaneous and a habit again.

Benefits

Being a 24-hour service enables customers in rural areas to make deposits conveniently.

Less time consuming compared to the existing procedure.

Customer does not need to visit the bank, thus saving his travel cost Encourages children to save conveniently on their own.

Enables customers to conveniently deposit even a minimal amount of cash, as some customers think it is not worth to go to the bank to deposit small deposits such as Rs. 100.

Increases the savings deposit base of banks.

Minimises the risk of counterfeit money being deposited.

Reduces the risk in transportation of money.

Capacity to mobilise the service islandwide, enabling all citizens to have equal access to a convenient depositing mechanism.

Enables daily paid workers to deposit their earnings conveniently, especially in rural farming and agricultural areas.

Higher profitability compared to general banking customers, as less customer acquisition cost and less operational cost.

Higher frequency of deposits by low net-worth individual customers than the high net-worth customers, thus leading to a higher total deposit yield islandwide.