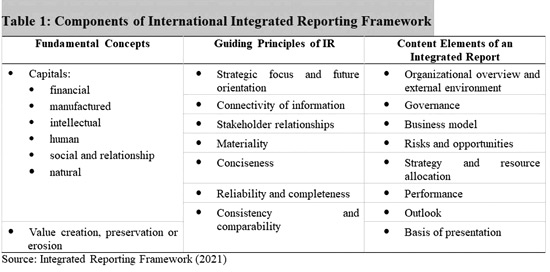

Integrated reporting (IR), which entails a new and innovative approach to current corporate reporting practice, is now being frequently used in manycountries, on voluntary basis, following the International Integrated Reporting Framework issued by the International Integrated Reporting Council in 2013 and subsequently revised in 2021. The International Integrated Reporting Framework consists of 2 fundamental concepts, 7 guiding principles and 8 content elements (see Table 1). Owing to the principal-based nature of International Integrated Reporting Framework, however, there is a considerable discretion for the companies to decide on how they would narrate their story of value creation.

This article reveals the results of a quantitative study conducted to examine the coverage and trends in reporting the content elements in integrated reports published in the financial year from 2015/2016 to 2017/2018 by the Sri Lankan public listed companies following the International Integrated Reporting Framework. This is one of the first studies that evaluate the compliance of IR adopters with the International Integrated Reporting Framework overtime in the entirety of a single country. It also develops a comprehensive index to capture the disclosure requirements of IR and extends the analysis to a voluntary context. The results of this study offer valuable guidance to practitioners, professional accounting bodies, business schools/universities and external corporate information users such as policymakers and investors.

This article reveals the results of a quantitative study conducted to examine the coverage and trends in reporting the content elements in integrated reports published in the financial year from 2015/2016 to 2017/2018 by the Sri Lankan public listed companies following the International Integrated Reporting Framework. This is one of the first studies that evaluate the compliance of IR adopters with the International Integrated Reporting Framework overtime in the entirety of a single country. It also develops a comprehensive index to capture the disclosure requirements of IR and extends the analysis to a voluntary context. The results of this study offer valuable guidance to practitioners, professional accounting bodies, business schools/universities and external corporate information users such as policymakers and investors.

Key Findings

Overall integrated reporting coverage and trend

Figure 1 summarizes overall coverage of IR adoption of Sri Lankan public listed companies from 2015/2016 to 2017/2018 based on the mean (average) values of total IR scores calculated using the disclosure index developed in the study. The findings of the study indicate an increase in the extent and trend of the overall coverage in the content elements of the integrated reports prepared by the Sri Lankan public limited companies during this period.

Figure 1: Overall coverage of IR

The analysis shows that the companies that can be broadly categorized under the non-financial sectors (i.e., material and consumer staples) have better reporting scores than the companies in the financial sector. Although more financial sector companies adopt IR in Sri Lanka, the coverage of content elements presented is at an average level.

This increasing overall trend and coverage of content elements of IR in Sri Lanka are attributable to the influence of different external institutional pressures on corporate reporting. These include active propagation of IR by professional accounting bodies and Universities and the availability of professional accountants competent to engage in new reporting models such as IR, can be considered as significant normative pressures in the Sri Lankan context towards IR adoption. Specially, the availability of award schemes to recognize best reporting entities in IR and the public seminars, workshops and capacity building programs conducted by professional accounting bodies have a major impact on IR adoption. These award schemes can also instigate mimetic pressure for the adoption of IR in Sri Lanka, as award winning companies in certain industries influence their peers to mimic this reporting practice. The coercive pressure emanating from the “Code of Best Practice in Corporate Governance-2017” of the Institute of Chartered Accountants of Sri Lanka can be another influencing factor. However, the coercive pressures’ influence is not significant compared to the normative and mimetic pressures for IR adoption in the Sri Lankan context. Further, the effective integrated organizational processes and practices in some of the IR adopting companies have also contributed to the increasing extent and trend of IR coverage in Sri Lanka.

As all these external institutional pressures and internal organizational initiatives explicitly promote the adoption of International Integrated Reporting Framework, the higher overall coverage of content elements provides evidence as to the success of these efforts taken in Sri Lanka.

Coverage and trend of individual content elements

Figure 2 summarizes the rankings of individualcontent elements based on the coverage from the financial years 2015/2016 to 2017/2018.

Figure 2: Rankings of content elements based on the coverage

The content elements, ‘basis of presentation’ ‘governance’, ‘organization overview and external environment’and ‘outlook’ have reported a higher extent and trend of coverage over the considered three-year period. It is noteworthy to observe that most of these content elements, which have recorded a higher coverage, include specific information required by accounting standards and corporate governance regulations, in a non-binding way in other areas.

Moreover, the content elements ‘strategy and resource allocation’ ‘performance’ and ‘risk and opportunities’ indicate a lower level of coverage. These least disclosed content elements are mostly comprising non-financial information and commercially sensitive information. In general, organizations are reluctant to report commercially sensitive information on their strategies and plans to protect their reputation and competitive advantage. This could have contributed towards the Sri Lankan companies to provide generic disclosures as to future uncertainties and prospects.

Moreover, the content elements ‘strategy and resource allocation’ ‘performance’ and ‘risk and opportunities’ indicate a lower level of coverage. These least disclosed content elements are mostly comprising non-financial information and commercially sensitive information. In general, organizations are reluctant to report commercially sensitive information on their strategies and plans to protect their reputation and competitive advantage. This could have contributed towards the Sri Lankan companies to provide generic disclosures as to future uncertainties and prospects.

The findings of this study suggest that some difficulties exist in identifying forward-looking information and quantifying industry trends based on information provided under ‘performance’, which will deter the investors and other stakeholders from evaluating a company’s ability to create value over the medium and long term. Moreover, the limited connection exhibited among different components, such as directors’ remuneration and value creation and business model with strategy and value creation, signifies a lack of attention toward integrated thinking that hinders creating value in the long term.

Further, it can be highlighted that the coverage of disclosures under truly innovative content elements such as ‘basis of presentation’ and ‘business model’ have also increased over time in the Sri Lankan context.

Key Takeaways

The results of this study involve several implications for international policymakers (e.g.,International Integrated Reporting Council) and local policymakers (e.g.,Securities and Exchange Commission of Sri Lanka), investors, practitioners, professional accounting bodies and business schools as elaborated below.

For Policymakers

Provide specific guidance in the preparation of integrated reports to facilitate the operationalization of a principle-based framework such as International Integrated Reporting Framework.

Consider the increasing extent and trend of coverage in content elements as a sign of reaching a growing understanding and enthusiasm toward IR in compliance with International Integrated Reporting Framework.

Consider implementing International Integrated Reporting Council’sguidelines mandatory in Sri Lanka on a phased basis with a clear roadmap accompanied by establishing a monitoring mechanism, building capacity, providing guidance, and recognizing best reporting entities.

For Investors

Help to identify the importance of integrated reports with higher coverage of information for better investment decision-making. Specifically, integrated reports with higher reporting quality improve the value relevance of information and promote investor confidence, which can act as a catalyst for economic development.

For Practitioners

Focus on the insufficiently disclosed content elements such as ‘strategy and resource allocation’, ‘performance’ and ‘risk and opportunities’ to improve the extent of reporting.

Promote integrated thinking through organizational changes in terms of internal system development for information collection and reporting, deployment of resources and capacity building.

For Professional Accounting Bodies and Business Schools/Universities

Disseminate knowledge, develop industry-specific guiding documents and support knowledge sharing and capacity building in IR.

Incorporate a comprehensive discussion on IR into their accounting curriculum.

Revise the current evaluation criteria in IR award schemes to include the extent of coverage by moving beyond the considerations of mere compliance with the International Integrated Reporting Framework. The evaluation criteria developed in this study could be useful in this respect.

In conclusion, the collaborative involvement of the policymakers, investors, practitioners, professional accounting bodies and business schools is essential to promote integrated thinking and quality integrated reporting in the corporate world.

This article is based on the published source of:

Cooray, T.,Senaratne, S., Gunarathne, N., Herath, R. & Samudrage, D.N. (2021). Adoption of integrated reporting in Sri Lanka: coverage and trend. Journal of Financial Reporting and Accounting, 20 (3/4), 389-415. https://doi.org/10.1108/JFRA-04-2020-0116

Authors

Ms. Thilini Cooray, Lecturer, Department of Accounting, University of Sri Jayewardenepura.

Dr. Samanthi Senaratne, Senior Professor, Department of Accounting, University of Sri Jayewardenepura.

Dr. Nuwan Gunarathne, Senior Lecturer, Department of Accounting, University of Sri Jayewardenepura.

Roshan Herath, Lecturer, Department of Accounting, University of Sri Jayewardenepura.

Dr Dileepa Samudrage, Professor, Department of Accounting, University of Sri Jayewardenepura.