In the backdrop of an impressive performance in the fourth quarter of this year, predicting tea prices for the ensuing year needs careful consideration and a rational basis would be to evaluate the supply and demand scenario.

Global supply and demand

In analyzing global tea production statistics, it is evident that with the exception of Sri Lanka, all other producer countries have shown growth year-on-year. Production statistics available up to end November 2016 indicate a gain of approx 58 m/kgs year-on-year. The significant feature, however, is that almost all of these increases comprise teas of CTC origin.

Amidst this trend, upto end November, Sri Lanka recorded a deficit of 40.8 m/kgs.

Unconfirmed records indicate that Orthodox tea production from Vietnam also recorded a negative variance.

Taking into account the carried forward deficit in Orthodox tea production, it would be reasonable to conclude the total shortfall to be in the region of 50 m/kgs (Orthodox tea) a considerable deficit and, therefore, 2017 would begin with a distinct shortfall of Orthodox teas globally whilst the net position (Orthodox/CTC combined) recorded a marginal increase.

With this background, the following factors should be considered when forecasting the tea market for 2017.

In projecting the availability of tea (Sri Lanka tea production for 2017), other factors for due consideration would be the current weedicide policy, removal of the fertilizer subsidy and its impact on production.

From a global perspective, the improvement in consumption by producer countries which has in the recent past resulted in less availability for exports would be relevant.

Sri Lanka’s key export destinations which were seriously impacted in their buying due to political issues and the drastic currency depreciations with economic sanctions are all said to be showing some recovery with a more positive outlook expected in 2017. In addition, greater stability is expected in crude oil prices which is currently around USD 50 a barrel and is anticipated to reach USD 60 in 2017.

The likelihood of a devaluation of the Sri Lanka Rupee against the US dollar would be another factor for consideration.

Global tea production during the first quarter is usually low in all major producer countries including Sri Lanka which experiences its Western quality season during this period and will thereby attract additional demand for these seasonal quality teas.

India and China have been witnessing a steady growth in consumption as a combination of the increase in population and the rising per capita income level. Considering these market conditions and in particular the supply restriction of Orthodox teas, it would not be too optimistic to project a buoyant market for the first half of 2017.

The market demand for teas, thereafter, would greatly depend on how the global tea industry progresses during the first half.

Whilst tea prices are projected to be buoyant during the first half of 2017, for long term sustainability the industry needs re-engineering to achieve global competitiveness.

Sri Lanka’s cost in producing a kilo of tea is among the highest in the world. Rising input costs, declining productivity, uneconomic age profile in tea bushes and high social costs have led to declining profits.

Perhaps, higher productivity and cost reduction will have to be achieved for enhancing competitiveness of ‘Ceylon Teas’ in the world market in the medium to long term.

The global competitiveness of ‘Ceylon Teas’ will hence, largely depend on how quickly the industry addresses these vital issues.

Tea production

Sri Lanka Tea production from January to November 2016 totalled 264.7 m/kgs vis-à-vis 305.5 m/kgs during the corresponding period in 2015 recording a significant decline of 40.8 m/kgs (13%). High Growns declined 13.2 m/kgs (19%), Medium Growns declined 6.2 m/kgs (14%) and Low Growns declined 20.5 m/kgs (11%). Consequently, annual tea production is unlikely to surpass the 290 m/kgs.

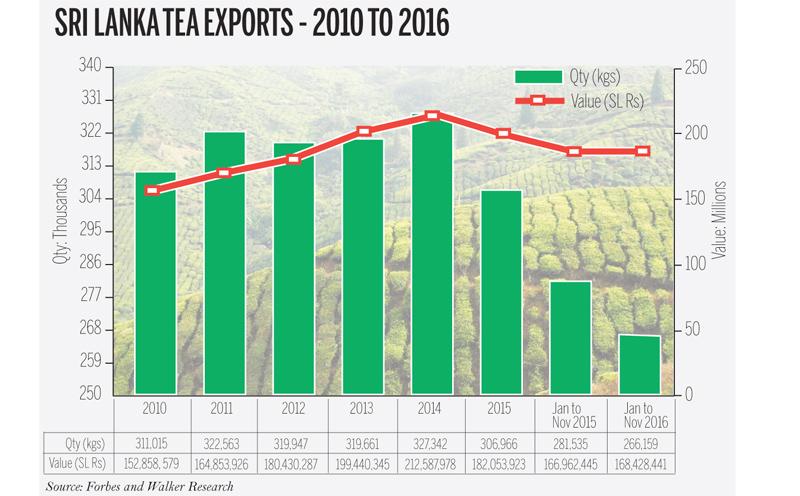

Tea exports

Exports from January–November 2016 totalled 266.1 m/kgs vis-à-vis 281.5 m/kgs from January–November 2015. This reflects a decrease of 15.4 m/kgs (a decline of approx 9%).

The total revenue of Rs. 168.4 b reflects a gain of Rs. 1.5 b vis-à-vis Rs. 166.9 for the period January–November 2015. Similarly total FOB value of Rs. 632.81 shows a gain of 39.76 vis-à-vis 593.05 from January–November. Export volume declined by 9%. And earnings from tea exports recorded a marginal growth of Rs. 1.5b (0.8%)

Source: Forbes & Walker Research