In 2016, tobacco use cost the Sri Lankan economy Rs. 213.8 billion, equivalent to 1.6 percent of its GDP.

Tobacco-related health expenditures totaled Rs. 15.3 billion. In addition, the economy experienced Rs. 198.5 billion in indirect productivity costs due to tobacco-attributable premature mortality, disability and workplace smoking.

By acting now to curb tobacco consumption, the Government can reduce the health and economic burden of tobacco use. The investment case findings demonstrate that over the course of the next 15 years, enacting and enforcing six FCTC tobacco-control measures, (MPOWER PROGRAM)( Monitor tobacco use and prevention policies, Protect people from tobacco smoke, Offer help to quit tobacco use, Warn about the dangers of tobacco, Enforce bans on tobacco advertising, promotion and sponsorship and Raise taxes on tobacco) avert Rs. 586 billion in economic losses, including about Rs. 542 billion in lost economic output.

By acting now to curb tobacco consumption, the Government can reduce the health and economic burden of tobacco use. The investment case findings demonstrate that over the course of the next 15 years, enacting and enforcing six FCTC tobacco-control measures, (MPOWER PROGRAM)( Monitor tobacco use and prevention policies, Protect people from tobacco smoke, Offer help to quit tobacco use, Warn about the dangers of tobacco, Enforce bans on tobacco advertising, promotion and sponsorship and Raise taxes on tobacco) avert Rs. 586 billion in economic losses, including about Rs. 542 billion in lost economic output.

The tobacco control measures stimulate economic growth by ensuring that fewer Sri Lankans -

1) drop out of the workforce due to premature mortality;

2) miss days of work due to disability and sickness, and

3) work at a reduced capacity due to smoking.

Lead to Rs. 44 billion in savings through avoidance of tobacco-attributable healthcare expenditures.

Of this, 55 percent of the total represents savings in Government healthcare expenditure, and 38 percent represents is savings to people in the form of avoided out-of-pocket expenditures.

Save 72,344 lives and reduce the incidence of disease.

Provide total economic benefits (LKR 586 billion) that significantly outweigh the cost of implementing the six tobacco control measures of the WHO - FCTC. (Rs 3.4 billion).

Highest return on investment

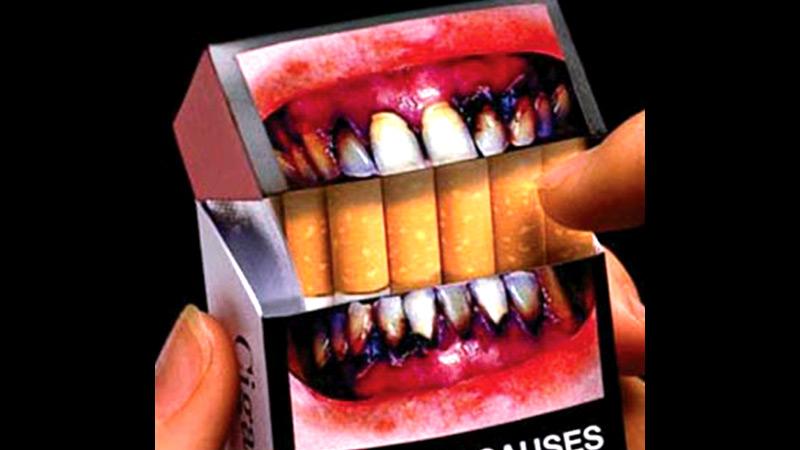

Each of the WHO FCTC provisions is highly cost-effective. Raising cigarette taxes has the highest return on investment. Over the 15-year period, for every Sri Lankan rupee spent to administer and collect the cigarette taxes, the Government can expect to see 724 rupees in return. Enacting more stringent bans on advertising has the next highest return on investment, followed by implementing plain packaging of tobacco products, expanding and enforcing bans on smoking in public places, anti-tobacco mass media campaigns and prohibiting sale cigarette sticks individually.

Strong fiscal and regulatory measures can powerfully influence norms by signalling to the population that smoking is harmful. Sri Lanka has a set of tobacco policies already in place to reduce the demand for tobacco products and protect the health of its population.

In 2006, during the Government of President Mahinda Rajapaksa, the Government established the National Authority on Tobacco and Alcohol Act (NATA). Professor Carlo Fonseka acted as the founding Chairman of NATA. It was during this period that almost all the important tobacco control policies were implemented. Among the law mandated bans on smoking in enclosed public places, graphic health warnings on tobacco packages covering 80 percent of the pack, and bans on advertising, promotion and sponsorship of tobacco products and sales by and to minors.

However, the law contains gaps allowing for product displays at the point-of-sale and some indirect forms of advertising, including tobacco industry sponsorship of events or activities.

Sri Lanka has a mixed tax system that includes specific excise taxes, tiered ad valorem taxes that vary by length of the cigarette and a sales tax. In 2016, the share of taxes as a percent of the retail price of the most sold brand of cigarettes was estimated to equal 62 percent. Raising taxes to represent at least 75 percent of the retail price of cigarettes represents an opportunity to lower smoking prevalence and increase government revenue. Therefore, the National Authority on Tobacco and Alcohol (NATA) should propose the Government for regular tax increases to raise the tax share to at least 75 percent of the retail price of tobacco, with additional increases to further lower consumption and ensure taxes outpace inflation.

Sri Lanka does not currently prohibit the sale of single cigarette sticks. Allowing their sale neutralises two other FCTC demand-reduction provisions. First, when purchasing cigarettes as single sticks, consumers are not exposed to the graphic warning labels covering 80 percent of tobacco products warning about harm to health. Second, the sale of single cigarettes lessens the impact of tax increases. Increasing taxes is intended to lower the affordability of tobacco. However, when cigarettes are available to purchase as single sticks at low prices, smokers who might otherwise quit facing the price of a full package can afford to continue buying single cigarettes.

No recent, national-scale anti-tobacco mass media campaigns have taken place. Informational campaigns represent an opportunity for Sri Lanka to address tobacco use through education and communication.

In 2016, tobacco use caused an estimated 20,000 deaths in Sri Lanka, 55 percent of which occurred in Sri Lankans under age 70. As a result, Sri Lanka lost productive years in which those people would have contributed to the workforce. The economic losses due to tobacco-related premature mortality are estimated at Rs. 179.3 billion.

While the costs of premature mortality are high, the consequences of tobacco use begin long before death. As people begin to acquire tobacco-attributable diseases (e.g., cardiovascular disease, cancer), expensive medical care is required to treat them. Spending on medical treatment for illnesses caused by smoking cost the Government Rs. 8.3 billion in 2016, with Sri Lankan citizens picking up an additional Rs. 5.9 billion in out-of-pocket healthcare expenditures - and private insurance or other forms of healthcare covering Rs. 1.1 billion. In total, smoking resulted in Rs. 15.3 billion in healthcare expenditures.

In addition to driving healthcare costs, as people become sick, they are more likely to miss days of work (absenteeism) or to be less productive at work (presenteeism). In 2016, the cost of excess absenteeism due to smoking-related illness was Rs. 4.2 billion - and the costs of presenteeism due to cigarette smoking are estimated at Rs. 11.0 billion.

Finally, even in their healthy years, working smokers face productivity loss due to smoking. Smokers take at least five more minutes per day in breaks than non-smoking employees. Suppose five minutes of time is valued at the average worker’s salary; in that case, the compounding impact of 1.3 million employed daily smokers taking five minutes per day for smoke breaks is equivalent to losing Rs. 3.9 billion in productive output annually.

Smoking cost Sri Lanka’s economy Rs. 213.8 billion in 2016, equivalent to about 1.6 percent of Sri Lanka’s GDP.

By implementing new FCTC policy measures - or intensifying existing ones, Sri Lanka can secure significant health and economic returns - and reduce the Rs. 213.8 billion in direct and indirect economic losses due to tobacco use.

Over 15 years, Sri Lanka would save about Rs. 585.9 billion that would otherwise be lost if it does not implement the package of tobacco measures. On average, that is the equivalent of about Rs. 39.1 billion in annual savings.

The savings derive from lowering direct and indirect costs of tobacco use. With better health, fewer individuals need to be treated for complications from the disease, resulting in direct cost savings to the government. In addition, better health leads to increased worker productivity. Finally, because the prevalence of smoking declines, fewer individuals take smoke breaks in the workplace.

Medical expenditure

Importantly, implementing the package of tobacco measures reduces medical expenditure for both citizens and the government. Currently, private and public annual health care expenditures in Sri Lanka are about Rs 332 billion, 4.6 percent of which is directly related to treating disease and illness due to tobacco use (about Rs. 15 billion).

Year-over-year, the package of interventions lowers smoking prevalence, which leads to less illness, and consequently less healthcare expenditure. Over the time horizon of the analysis, the package of interventions averts Rs. 44 billion in healthcare expenditures, or about Rs 3 billion annually, with 55 percent of those savings accruing to the Government, 38 percent to citizens who would have paid out-of-pocket for healthcare, and the remainder to other voluntary healthcare pay schemes. Thus, from the reduced healthcare costs alone, the Government stands to save about Rs. 24 billion over 15 years.

Simultaneously, the Government would successfully reduce the health expenditure burden that tobacco imposes on Sri Lankans, supporting efforts to reduce economic hardship on families. Rather than spending on treating avoidable diseases - these families would be able to invest more in nutrition, education and other productive inputs to secure a better future.

An investment is considered worthwhile if the gains from making it outweigh the costs. A return on investment (ROI) analysis measures the efficiency of the tobacco investments by dividing the economic benefits that are gained from implementing the WHO- FCTC measures - by the costs of the investments. For the Sri Lankan investment case, the ROI for each intervention was evaluated in the short-term (period of 5 years) and in the medium-term (period of 15 years). The ROI shows the best return on investment for each intervention and the full package of measures. Net benefits are a measure of which interventions are expected to have the most significant impact.

Over the 15-year raising taxes is expected to have the highest return on investment. For every Sri Lankan rupee invested in tobacco control, the government can expect to see 724 rupees in economic benefits in return. Bans on advertising have the next highest ROI (366:1), followed by plain packaging (278:1), expanding and enforcing smoke-free public places (245:1), implementing a mass media campaign (144:1), and single stick ban (93:1).