With the introduction of the new Inland Revenue Bill, the government is geared to streamline the tax system in the country to ensure that taxpayers, both, individuals and business entities give back. Speaking, to the Sunday Observer, Prof. Ashu Marasinghe explained how the Government intends to increase government revenue to three trillion rupees by 2025. According to him, this target can be reached with a minimum effort and ‘if the tax system is properly streamlined government’s tax income should be ideally better than what Sri Lanka stands at, today.

Excerpts:

Q. What is the purpose of the new Inland Revenue Bill and what does it try to achieve?

The new Inland Revenue Bill is the most simplified Bill you can find, it’s easily comprehensible and very proportionate in its application. A tax bill should be proportionate in its application. The previous law or the Act had some loopholes. A majority of the people used it to their advantage to not pay taxes due to the government. These loopholes will be addressed through the new law.

The new Inland Revenue Bill is the most simplified Bill you can find, it’s easily comprehensible and very proportionate in its application. A tax bill should be proportionate in its application. The previous law or the Act had some loopholes. A majority of the people used it to their advantage to not pay taxes due to the government. These loopholes will be addressed through the new law.

But, in order to achieve the Bill’s full potential we have to make sure that the relevant authorities the Act talks about also should be reformed. Customs, Excise Department and the Inland Revenue Department should be reformed.

Any other country you visit, be it for employment or studying or both, the first thing they do is, open a tax file for you. This doesn’t necessarily mean you earn, and definitely doesn’t mean you have to pay taxes unless you are earning. A tax file can actually portray a person’s discipline. Therefore, for starters any voter should maintain a tax file irrespective of them needing to pay taxes or not.

Q. What’s the mechanism that will be used in streamlining the tax processor in monitoring taxpayers?

The Inland Revenue Department introduced a new system called the Revenue Administration Management Information System (RAMIS) sometime last year. But in introducing this system there had been some basic mistakes. The officials trained in the system or the program are not IT savvy. This is wrong. A person who doesn’t possess the necessary IT knowledge cannot operate and work under this system. We discussed this in the Public Finance Committee, and its recommendation is that an auto-generated number should be used in opening tax files.

However, my view is different. I have made the proposition of using the identity card number for all these purposes, a digital ID. This should be a person’s tax file number as well. The drawbacks of introducing an automatically generated number are that the systems can get deleted or corrupted. It can be done intentionally or owing to an act of a third party.

Then, a unique ID, such as, using a person’s identity card number can be used as a primary key in the system, which will make the taxing system way more easier to track transactions and trace where the money goes. So we have to set in a better system or find solutions to any existing issues in the current system.

Q. How do you plan to increase government revenue up to three trillion rupees?

At least by 2025, we should be able to increase government income to three trillion rupees. It would be better if we can get there before 2025, but we must be there at least by 2025. If this tax system is streamlined properly, it is even achievable by 2020.

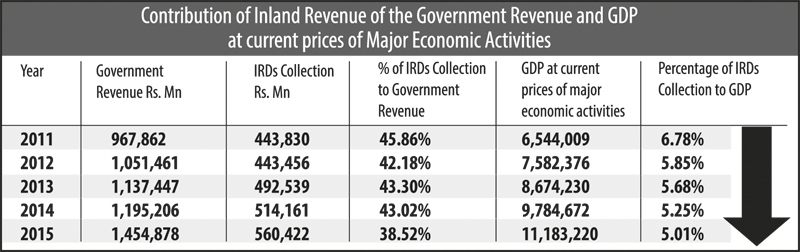

In 2016, our income was only 1.6 trillion rupees; this is including tax revenue and non-tax revenue. When it comes to taxation what takes centre stage are the direct and indirect taxes. The direct tax component should be at least 40 percent. Currently, we stand at 13 percent. The remaining 60 percent should be indirect taxes, this is our target for 2020.

Sri Lanka is the lowest in the region in collecting taxes. We stand at 13.1% whereas, the Maldives is at the top with 32.9%. If we reach our target in increasing the income tax component to 40 percent, we will be at the top in the region.

Q. Around 95 percent of taxpayers don’t reveal their true income and end up paying taxes for a lesser income. How do you plan to overcome this?

94 percent of the government revenue is collected from a mere 768 companies that pay taxes. If we decide to properly monitor these existing taxpayers today, we could reach our target, that is, without increasing the number of taxpayer companies. At least, 5 percent of these companies that pay taxes don’t reveal their true numbers or pay the proper tax amount that should be paid. At least 10 percent of existing taxpayers don’t reveal their proper turnover. At least 2 percent doesn’t reveal their true year-end stocks. So what we need is innovative thinking for a better administration of taxing. We need honesty, both in officials and in taxpayers. Due to dishonesty, a substantial portion of the income tax due to the government doesn’t come in. What they fail to realize is that taxpayers sometimes spend an equal amount or even more for tax evasion. Therefore, we need to streamline this at the earliest.

Due to this incapability of collecting tax, about 16.5 percent of lower income earners have not been able to get their benefits, and funds that can be utilized for development projects have not been collected. At present, we run this country with just a fraction of what the government is entitled to get. Most importantly, we need to provide an incentive to pay their taxes regularly and properly. In other countries, an individual’s or company’s tax file is considered as a statement on that individual or the company.

Q. The JVP alleges that the new tax Bill is drafted on IMF recommendations or their request, what do you say about it?

I categorically deny this. They always tend to see the negative aspect of anything. Today, there is a handful of politicians who genuinely want to make a change in the system. We really try to achieve something here, and we have the visionary leadership that we require. Hence, it’s up to us to take this forward. We are not employees or representatives of the IMF, we are government representatives.

The Public Finance Committee is a good example. All the work that we have done is through this Committee. We have monthly meetings with about 40 institutions on this subject. This is the money that should be utilized for the development of the country, and who are rightful owners of these benefits.

Q. What if someone questions the government as to why they should pay taxes when the government doesn’t utilize it for the betterment of the people or the country, but waste it on unnecessary expenditure?

I don’t see that government revenue is being misused. It is a misunderstanding. This is why we took over the government. I do agree that the current government has some shortfalls, but we have to admit that we have achieved to a certain extent. That is what good governance is about and this is another way of achieving good governance. I strongly believe, we can achieve these targets.

Q. Taxing professionals is a new component that will be introduced, could you explain the rationale behind this?

If you take doctors as an example, who are engaged in private practice, we have identified that there is no way of properly gathering information on their income, and taxing the professionals. They either pay very little tax or don’t pay at all, but if you look at their spending profile it is obvious they should be paying more taxes than they do. Lawyers and other professionals are the same. So these professionals should be honest and give back to the country. The government too has an equal burden and a responsibility to properly utilize and invest these tax revenues.

Q. Another allegation is that taxes on agriculture and EPF, lottery winnings scholarships and other grants have been increased, and concessions are given for stage dramas, music, new inventions and life insurance on senior citizens have been lifted. How can this be a decision in the right direction?

This is a wrong interpretation. MP Sunil Handunetti made this statement in Parliament. This is not what we have introduced. Income tax is based on profit. Concession and profit are two different things. We have stated that a 24% tax should be applied to films on the profit they make, and not on the income. We have not removed any concessions. We have allowed them to be relieved from income tax, but the issue is taxing artists on their income is not doable. Some do extremely well and generate a massive profit, all we aim at is that a reasonable proportion of the profit is paid back through tax.

Q. Another factor is that the money allocated for Ministries through the Budget is not properly utilized for development projects. Then there is mismanagement of these public funds which also includes taxpayer’s money?

The best solution is the Oversight Committees initiated under the guidance of the Prime Minister. Currently, about 16 Oversight Committees have been appointed. The Public Finance Committee is also part of this. It is through the Public Finance Committee that we establish and monitor the budget office. Then, monitoring of budget funds, allocations, its use and misuse can be properly carried out.

Q. Is merely monitoring sufficient? Can Ministers be held for their actions and inactions under the budget office?

Evaluation is key here and they are answerable to Parliament. Under the Act that established the Oversight Committees they are answerable and responsible to Parliament. We can question any Minister. COPE and COPA are different committees as it’s more of a post-mortem that is carried out. But the Public Finance Committee is an on-going evaluation process.

By September this year, there were Ministries that we had identified who had not utilised even fifty percent of the allocation given to them. These should be corrected. Now the Ministers are given to monitor these activities through Oversight Committees. Like in any other profession or workplace you get Ministers and Members of Parliament who do their jobs and there are others who slack.

Q. When will the Ministers and MPs start paying taxes?

I have opened a tax file for myself and I pay my taxes as a parliamentarian. That is something we will enforce and it’s a must. Every individual who makes an earning should pay a tax to the government. Tax files should be opened for all 225 Members of Parliament.