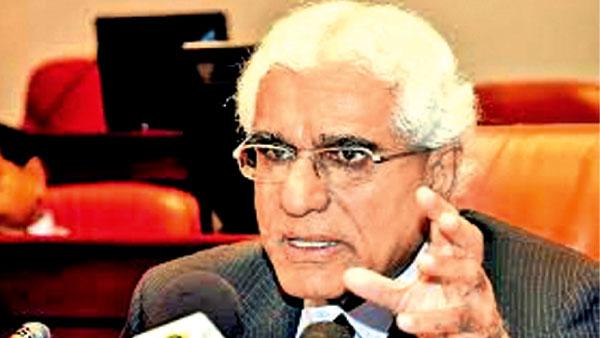

The Governor of the Central Bank of Sri Lanka, Dr. Indrajit Coomaraswamy said yesterday he was optimistic that pressure on Sri Lanka’s external trade account and the exchange rate will ease following the government’s recent fiscal policy decisions to contain imports of vehicles and gold.

|

Scope to cut bank deposit and lending rates - CB The Central Bank of Sri Lanka on Friday expressed concerns on the rigidity of the deposit rates and lending rates offered by Sri Lanka’s commercial banks given that there is more leeway for the rates to be reduced. Addressing a press conference on Friday, Central Bank Governor Indrajit Coomaraswamy said that this concern of the banking regulator has been conveyed to the Chief Executive Officers of Banks during recent meetings. “We do think that both bank deposit and lending rates now need to come down given that there is liquidity in the system following a declining trend witnessed in the Treasury rates and the Average Weighted Call Money Rates. We will monitor the market rates going forward and see how that develops,” Governor Coomaraswamy noted. |

In April this year, the government re-imposed a 15 percent tax on gold after a five-year hiatus while a tax hike on smaller cars was announced last week to arrest the sharp spike in imports.

“One of the positive developments of late is that subsequent to the government adjusting the gold duties, gold imports have eased off and the tax hike has had the desired impact. With the recent increase in vehicle taxes, going forward, hopefully the pressure on the trade account should be reduced because two of the three pressure points, i.e. gold and motor vehicle imports would be contained,” Dr. Coomaraswamy said noting that the third factor is oil imports whose prices are however beyond the control of the domestic authorities.

According to recent trade statistics, Sri Lanka’s cumulative deficit in the trade account during the first five months of 2018 expanded by US$ 716 million from US$ 4,198 million to about US$ 4,914 million while the trade deficit in the month of May 2018 widened by US$ 49 million to US$ 933 million. Out of the cumulative trade deficit of US$ 716 million, around US$ 350 million is attributed to the increase in vehicle imports, said Central Bank officials.

For the month of May 2018, while Sri Lanka’s expenditure on import of vehicles increased by 120% to US$ 149.3 million, imports of gold reduced drastically by nearly 100% from US$ 35.8 million in May 2017 to a mere US$ 0.1 million.

Meanwhile, when asked whether the Central Bank expects an immediate easing in the pressure of the currency with the latest vehicle tax hikes, the governor replied negatively noting that time has to be provided for the already opened Letters of Credit to go through.

“The pressure on the currency has come down a lot over the last couple of weeks and hopefully that will continue. But, with the new measures the desired effect may take a couple of months,” the governor said.