In 2018, Gross Domestic Product (GDP) of Sri Lanka was Rs. 14,449,931 million and the contribution of the Department of Inland Revenue (IRD) for the GDP was Rs.900, 348 million and revenue collection of the Department of Inland Revenue as a percentage of the GDP was 6.23. Following figures show the revenue for five years ending in 2018. (See Table 1)

As the main revenue collector of the Government, the Inland Revenue Department’s tax collection hovered around 5 percent of the GDP, and there is a declining trend if we peruse the records from the 1990s.

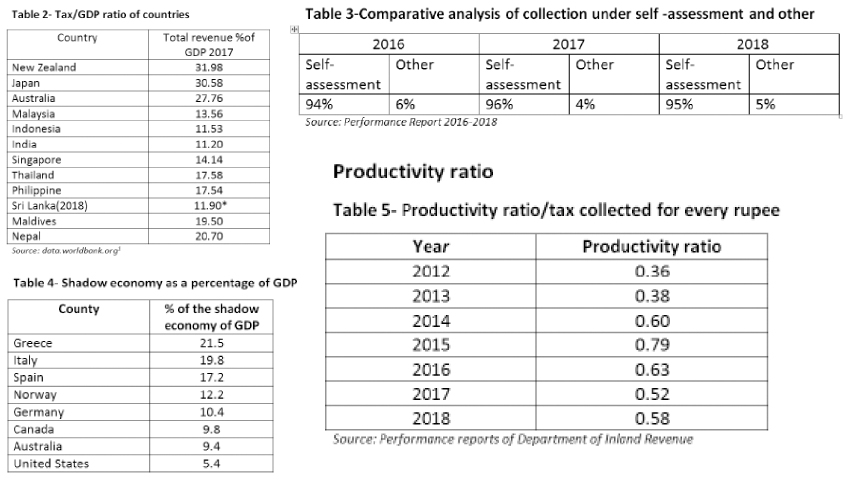

The tax collection as a percentage of the GDP is far less compared with that of the other Asian countries as well as with the developed countries. The following table shows the tax/GDP ratio of a few countries. (See Table 2)

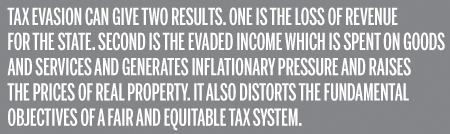

When the total tax collection is analysed further, it can be divided into two categories as self-assessment and “the other”. Self-assessment means the taxes paid by the tax payers on their own to the banks and the “other” category includes the taxes collected by way of investigations and the arrears collection of taxes for previous years.

(See Table 3)

The taxes collected by way of investigations by the IRD (“other”) are trivial when compared with the collection of taxes by way of self-assessment paid by the tax payers on their own. On the other hand, the cost of the tax collection has gone up rapidly over the last two decades. Table 5 shows the cost of tax collection from 2012 to 2018. (Table 5)

The taxes collected by way of investigations by the IRD (“other”) are trivial when compared with the collection of taxes by way of self-assessment paid by the tax payers on their own. On the other hand, the cost of the tax collection has gone up rapidly over the last two decades. Table 5 shows the cost of tax collection from 2012 to 2018. (Table 5)

The table - 5 shows the productivity ratio of the IRD. That is to collect Rs 100, the expenditure is 36 cents in 2012 and the ratio in 2018 was 58 cents. There is a considerable increase in expenditure with regard to the collection of taxes over seven years from 2012 to 2018.

There was a cadre of 875 officers in the executive grade as at 31/12/2009 and the number of officers was increased to 1,232 as at 31/12/2014. It was a considerable increase aiming to raise tax collection among other things. The cadre in the grade of executive level shows a 51.89 percent increase since 2009. This is a good omen from the aspect of officers in the Inland Revenue Department, but it does not show output wise result as a whole. Physical infrastructure facilities, such as computers and other facilities required for the performance of duties have been provided. Performance reports of the IRD show that officials have been sent for capacity building programs in foreign countries.

Reasons for decline of revenue by IRD

There are many reasons for the decline of Government tax revenue in spite of the overall increase in the GDP and per capita income over the last two decades. According to the report of the Taxation Commission 1990, some of the reasons are as follow;

• Unplanned ad-hoc tax incentives in the form of various tax holidays, relief and concessions and duty waivers.

• Narrow tax base and coverage, the total number of tax payers being about three percent of the population;

• Increase in allowable expenses under the provisions of the Inland Revenue Act;

• The existence of a large informal economy resulting in large scale tax evasion and avoidance.

• A growing interest in what is termed as underground economy that financial activities in the underground economy are described by a variety of terms, such as informal, parallel, unofficial and black.

• The informal credit market or the extent of black money has been estimated at Rs 13 billion, or about 6 percent of the GDP. It is difficult in the absence of data to quantify foreign money held undeclared by Sri Lankans in foreign countries or the informal foreign exchange market and entire underground economy.

• A complicated tax system and weakness in tax administration and the administrative mechanism

Black economy

Underground economy and the narrow tax base are prominent, according to the aforesaid reasons. The tax base may have been narrowed due to the fact that a large number of money transactions take place without the knowledge of the tax authorities. It is a common knowledge that in the context of the present day world, there is a shadow economy apart from the visible economy. Black economy is a situation where money is earned by way of illegal methods and not declared for tax purposes.

The shadow economy is a situation where work is done for cash to avoid incurring tax and without following standard business practices. In such a situation, Government has no control over them because their dealings in trade are not recorded. As a result, revenue authorities have no clue with regard to such a segment of persons. This could be anything from paying tradesman for a baby doll in undeclared cash to the illegal drug trafficking or arms dealings, counterfeit trade and money laundering. The World Economic Forum’s (WEF) council on illicit trade 2012-2014 estimates the global shadow economy to be worth US $ 650 billion. The shadow economy as a percentage of the GDP in a few countries (2017) will give an idea about the issue. (Table 4)

All over the world, the shadow economy or the black economy prevails willingly or unwillingly. Sri Lanka is not an exception. Tax evasion is not a new phenomenon. The 1955 taxation Commission referred to the prevalence of widespread evasion and said that “when evasion is widespread, it brings the whole system into disrepute and even the honest man is tempted to conceal his true income and delay payment as much as possible.” The 1966 Taxation Inquiry Commission also carried a reference to the prevalence of widespread evasion and added that the precise extent of evasion is impossible to assess.

According to the report of the taxation commission in 1990, the share of the informal market accounted for six percent as at the end of 1989. The informal economy goes hand in hand with tax evasion. Therefore, the shadow economy or the underground economy where tax evasion is rampant is an area where tax authorities are supposed to pay attention with a high priority.

Tax evasion and avoidance

Tax evasion can take diverse forms. These include non-declaration or under-declaration of income and assets, over-statement of expenditure or exemptions, fictitious expenses, concealment of sales, stocks, and debtors, fictitious creditors etc. Tax evasion is a violation of the tax laws, where a taxable person reduces the tax liability by illegal means. This may be accompanied by the deliberate omission of income or turnover, the fraudulent claims of expenses and allowances. There are persons in the informal sector who are not filing tax returns at all.

Tax evasion can give two results. One is the loss of revenue for the State. Second is the evaded income which is spent on goods and services and generates inflationary pressure and raises the prices of real property. It also distorts the fundamental objectives of a fair and equitable tax system.

Tax avoidance, on the other hand, denotes tax saving through legal means. Tax avoidance has been defined as the “art of dodging without actually breaking the law”. In an extended meaning, the term is used to describe the tax saving by the adoption of various tax sheltering devices.

These devices take the form of artificial arrangements of personal and business affairs to take advantage of loopholes or anomalies in the law. Reducing the payment of tax should not be encouraged either by evasion or avoidance. But one cannot be stopped if he or she uses the mechanism to reduce payment of taxes by avoidance by using the loopholes in the mechanism. Nevertheless, there is a close connection between these two terms, but at the same time, there is a considerable difference as well. According to Denis Winston Healey, “the difference between tax avoidance and tax evasion is the thickness of a prison wall.”

According to economists, the Sri Lankan economy consists of a considerable amount of shadow economy or a black economy where trade transactions are not recorded and bypass tax authorities. It is in this background that the Government has introduced an Act to prevent money laundering in Sri Lanka. The Prevention of Money Laundering Act No. 5 of 2006 provides measures to combat and prevent money laundering and provides for matters connected therein or incidental thereto. Taking action by the Government to enact a law to prevent money laundering itself proves that there is money laundering where there is a black economy and tax evasion. This article attempts to evaluate the way in which the tax evaders in the shadow economy are tackled by using tax laws introduced to prevent money laundering in the country.

Money laundering and Department of Inland Revenue

Tax collection of the country has been in a declining trend since the 1990s. The contribution of the tax collection by the Department of Inland Revenue for the GDP as a percentage has been diminishing despite the fact that the GDP and the per capita income have gone up. The contribution of the tax collection of other countries in Asia shows a better situation compared to Sri Lanka.

Various reports have shown that there is a shadow economy which is estimated to be a six percent of the GDP. The tax base is only three percent of the total population in the country. Therefore, it is imperative for the Inland Revenue Department to increase its contribution to the country’s total revenue collection. A clear cut avenue in this regard is the shadow economy which should be investigated and tax evasion should be avoided. Tax evasion can be identified on the analysis of money laundering at several stages.

Money laundering is the process of washing dirty money to make it look clean. In other words, money laundering is the process of hiding the source of money received by illegal means. In a shadow economy, there are lot of activities that monies are coming into the hands of criminals, such as by way of drug trafficking, smuggling, bribes, corruption and commission.

According to the International Monitory Fund (IMF), money laundering is the process of assets generated by criminal activity to obscure the link between the funds and their illegal origins. Money received from criminal activities may be obtained through tax evasion, drug trafficking, embezzlement and fraud. Criminals want to “wash” or “launder” such proceeds to disguise their illegal origin.

They use banks, finance companies, leasing companies’ by depositing money, leasing luxury vehicles, housing loans, property loans for purchasing real estate. Criminals do this by disguising the sources, changing the form, or moving the funds to a place where they are less likely to attract attention. Tax evasion may take place without money laundering. Though all tax evasions may not be a result of money laundering, all money laundering may result in tax evasions. Money laundering and tax evasion are inter-related.

Stages of money laundering

Money laundering can be divided into three stages. The first stage is the placement where accumulation of dirty money by way of criminal activities takes place. Criminal cash will be brought in to the financial system at home or abroad in smaller sums. Cash may be converted in to other assets, such diamond, gold bullion or negotiable instruments, such as cheques and travellers’ cheques. Illegal money will also be converted into other currencies and money will be transported to countries other than the crime committed.

The second stage is the layering in which shell companies or trusts may be established. Banking activities will commence. Bogus invoices will be prepared where necessary. Back to back loans will be arranged. This involves transferring the cash acquired from illegal activities into financial institutions, obliterating the trail and the origin of the funds.

The integration stage is the third stage where money may be used in casinos or in purchasing real estates or other luxury assets and purchase immovable properties in the name of close relatives’ names. Finally, they will reintroduce the money back into the legitimate economy, creating an impression of legitimacy. During the money laundering, persons carry out dealings with the financial Institutions to which the Inland Revenue Department has access through the Financial Intelligence Unit of the Central Bank. (To be continued next week)