On April 25, 2019, the Board of the Millennium Challenge Corporation (MCC), approved a five-year US$480m compact with Sri Lanka which seeks to assist the Government in addressing two issues: (1) transport logistics infrastructure and planning; and (2) access to land for agriculture, the services sector, and industrial investors.

This has raised much controversy with allegations that this will open the door to foreign land grabs. Is there a need for this project? To answer this, we need to step back to understand some issues in the economy.

For decades it was assumed that the reason for the country’s lack of growth was the war; an assumption that seemed proved correct when growth spurted to an average 8% in the immediate aftermath of its ending.

Standard models expect that after the destruction of the capital stock during the war years, catch-up begins leading to higher growth until a steady state stock of capital is reached. If the end of conflict spurs increases in total factor productivity (through investment in skills, R&D etc., fostering innovation) this could sustain increased growth even longer.

A post-war boom should thus sustain for many years. An outstanding example is Rwanda where it has continued for over 20 years.

Sri Lanka’s post-war boom lasted a mere three years (2010-2012). From 2013 growth dropped to the long-term average of 4%, where it has remained. In the absence of war, why did growth slow?

Sri Lanka’s post-war boom lasted a mere three years (2010-2012). From 2013 growth dropped to the long-term average of 4%, where it has remained. In the absence of war, why did growth slow?

To understand this problem, the Harvard Centre for International Development conducted a diagnostic study on the constraints to growth. The proximate causes for slow growth were the lack of export diversification and the lack of FDI.

The Harvard team then focused on identifying the constraints that restrict investment in new and non-traditional exports. They examined the following: 1. Access to finance, 2. Human capital – education and health, 3. Infrastructure – transport, electricity, water, waste-water and sanitation, 4. Access to land, 5. Labour regulations, 6. Policy uncertainty, fiscal stability and rule of law, 7. Market failures

The study identified the critical ones that were holding back investment as: 1. Policy uncertainty, 2 Access to land, 3. Transport infrastructure, 4. Water, wastewater and sanitation.

Policy uncertainty: unpredictable changes in tax, trade policy are obvious. The transport infrastructure weakness is principally access to the port and acute congestion.

Surveys of existing and potential investors found that access to industrial land was difficult due to high congestion around Colombo. Even where land was available, the lack of wastewater treatment plants or access to industrial water sources renders it unsuitable for industrial purposes.

The obvious solution for industries is to try and locate within an industrial zone where these facilities are available - unfortunately all of the 12 zones established are full - which itself is a testament to the problem. The lack of transport infrastructure means that all industries seek land in the Western Province, leading to congestion and uneven development - all the activity concentrates in this area leaving the rest of the country underdeveloped.

The partial solution that is recommended is the development of further industrial zones which can alleviate the immediate problems but in the long term, the transport infrastructure needs to develop.

Following land reform, around 80% of all land is with the State and what private land is available is fragmented and dispersed. The lack of any central agency means the market for land is informal. Investors are confronted with the problem of dealing with brokers (often of uncertain character) who themselves have information on a limited number of properties.

Problems of forged deeds and fraudulent transfers increase risk for the unwary. While applications can be made to lease State land, the study notes: “A very large number of government agencies have responsibilities and control over plots of land and over land administration, but they lack systems for coordinating decisions. This makes land acquisition for investment costly and risky, and at times, virtually impossible.”

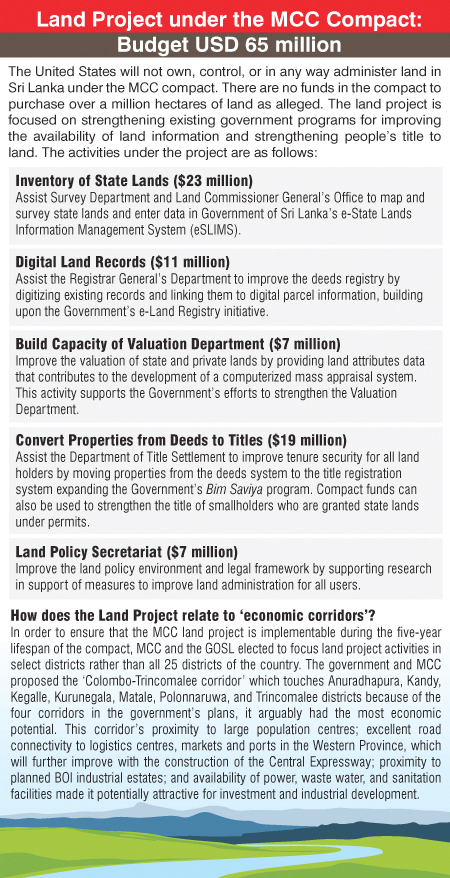

The MCC project addresses the above problems, for example by helping to develop an inventory of State land and improving the deeds registry.

This is vital, because a perusal of the Auditor General’s report of the Land Reform Commission (LRC) reveal rampant malpractice and fraud: land being sold, stolen or illegally occupied.

One of the main custodians of State land is the LRC which was vested with 987,906 acres of land.

Their records are so bad that the Auditor General has declined to express any opinion on the financial statements, a very serious matter.

(As per the Institute of Chartered Accountants of Sri Lanka: “The auditor shall disclaim an opinion when the auditor is unable to obtain sufficient appropriate audit evidence on which to base the opinion, and the auditor concludes that the possible effects on the financial statements of undetected misstatements, if any, could be both material and pervasive.”)

Among the weaknesses highlighted by the AG in the 2015 accounts are: (1) Non-availability of a land register, and registers on the leased lands, and the lands transferred by sale. (2) Non-preparation of a proper methodology for leasing land.

When COPA inquired into the extent of State land (Feb 2016) the Chief Accounting Officer of the Ministry of Lands had responded: “A data system had been installed for the management of State lands and the total number of lands belonging to the government was approximately 12 million plots and added that their target was to enter data on six million plots of land under 2016-2020 program.”

It appears from the response that a registry was in the course of being prepared. If the LRC lacks a proper register of lands it renders impossible even the most basic of stewardship of the assets in its custody.

This weakness is one of the areas addressed by the MCC compact.

Naturally, an absence of controls and records results in rampant abuse, some of which has been highlighted by the AG:

1. Failure to obtain approval of the Cabinet of Ministers for the disposal of lands, in violation of Decision No.11/Misc(015-1) dated 25 August 25, 2011 of the Cabinet of Ministers. (AG’s report 2016)

2. An extent of 98 acres out of the land called Muthuwanawatta at Nikapotha in the Badulla district was given on a 30-year lease in 2004 to a private company. As the transfer was irregular it had been cancelled by a decision of the Cabinet of Ministers dated August 12, 2004. Nevertheless, the Commission had taken a decision on August 26, 2008 to reinstate the lease. (AG’s report 2016)

3. An extent of five acres from the land of the Ambalamana Estate was transferred by sale in 1985 to a private company for a white quartz project and that transfer as well had been cancelled by a decision of the Cabinet of Ministers dated August 12, 2004. The company continues to occupy the land and has been excavating silica since 2002 and pays no royalties or rent. (AG’s report 2016)

4. An extent of 660 acres of the Pitagoda Valley Estate in the Galle District had been leased out on February 27, 2004 to a private company for a compost fertiliser production project. This lease was cancelled by a decision of the Cabinet of Ministers dated August 12, 2004. The company continues to occupy the land which it uses for some other activity, not compost fertiliser. No action taken to recover the land up to the date of audit. No rentals have been paid. (AG’s report 2016)

5. The lease of 280 acres of the Monerakele Estate which had been leased to a private company for a period of 30 years in 2011 without Cabinet approval. The lease rental of Rs. 10,764,622 recoverable from the company had not been recovered. (AG’s 2016)

6. The lease 20 perches of land of the Aberfoil Estate in the Division of the Kolonna Divisional Secretariat, of the Ratnapura district for 30 years for construction of a transmission tower. Rentals amounting to Rs. 2,707,711 had not been paid up to the date of the audit report. (AG’s report 2016).

7. Blocks of land up to 319 acres in extent of the Meddegedara Estate of 593 acres in the Kalutara district had been leased to six people in 2016 without a decision of the Cabinet of Ministers. The lease had been granted on a rough valuation of Rs. 4,546,000 without obtaining a Government Valuation. (AG’s report 2016)

8. Forty-nine acres, three roods, 30 perches from the land called Ethhondagala Nindagama in the Embilipitiya Divisional Secretariat of the Ratnapura district had been given to a private company on August 22, 2003 by obtaining a lease advance of Rs. 100,000. Lease rental and the surcharge of 10 per cent amounting to Rs. 2,527,224 remained unrecovered as at August 21, 2016. (AG’s report 2016).

These are not an exhaustive list of the problems but listed to illustrate the extent of the problem. They arise from fundamental weaknesses in systems and indicate gross negligence at the least.

The AG lists the following:

1. No documented procedures for lease of land.

2. Failure to comply with public sector accounting standards most seriously by under recording revenue by Rs. 85,399,656 or 40% in 2015.

3. Accounting deficiencies for example failure record income from granite resources leased out from the Kalutara district alone amounted to Rs. 20,152,185.

4. Unexplained differences in accounts, for example, a difference of Rs. 83,213,570 was observed in the lease rental income and a difference of Rs. 17,891,944 when comparing reports of revenue with the financial statements and a difference of Rs. 363,287,042 in amounts payable as compensation for land acquired.

5. Failure to recover amounts due on leases including Rs. 2,132,372,712 from seven public institutions over a period of 10 years and other lease rentals amounting to Rs. 87,915,051 over two years.

6. There is no coordination between the Income Division, the Land Transfer Division, the Projects and all other parties with the Accounts Division.

Far from permitting theft it is clear that proper records and registers, which the MCC project is assisting in creating will prevent such abuse while facilitating investment.

- The writer is an independent consultant