Amid controversies and squabbling over foreign debt repayments running into ‘billions’ and ‘trillions’, the Auditor General last week dropped another bombshell confirming that the loans repayable by the government to domestic and foreign sources stood at Rs.10,993 billion (Rs.10.9 trillion) as at November 2017 but there may be unaccounted figures.

This meant, every citizen of the country was burdened with a Rs.450,000 per capita debt hanging over his/her head. The Auditor General, Gamini Wijesinghe said, over 40% of the public debt was sourced from foreign lenders.

A media conference called by the Auditor General’s Department at the Department of Information, clarified the actual debt situation in the country, while the politicians had a field day with the hot topic at every election rally distorting facts, confusing the general masses further.

A media conference called by the Auditor General’s Department at the Department of Information, clarified the actual debt situation in the country, while the politicians had a field day with the hot topic at every election rally distorting facts, confusing the general masses further.

Wijesinghe said, the fiscal mismanagement had been at its worst during the last decade of governance and the former Finance Secretary who was dubbed the ‘economic hit-man’ was at the centre of the controversies, breaching every fiscal law/policy to appease his superiors.

“Therefore, contravention of procedures became the norm,” the Auditor General said, adding that most of the institutions have dealt with state funds like buying grocery stuff for their ‘home kitchens’ without following any proper procedure or sticking to any regulation or guideline .

“Vesting the subject of Finance with the Executive President was the biggest blunder that has been made,” Wijesinghe observed adding that however, little have changed now due to the ‘Mafia of Ministry Secretaries’ who are getting in the way of shedding the past bad practices of fiscal management .

“Today, the practice of noncompliance of proper procedures has been discontinued, but the officials, especially, the Chief Accounting Officers who are the Secretaries in the case of Ministries are seemingly not ready for the change. On top of that the legal system governing this sector is totally outdated. I don’t see any efforts to amend the law”, he said.

The Auditor General also observed that obtaining loans to fund state projects was not a bad practice but the issue was the absence of a strong repayment plan. He also voiced concern that the transactions needed to be more transparent. “The construction of the Expressways, for example, had been a highly commendable task. The income from the Expressways in the past years exceeded Rs.7 billion, so the loans obtained were not in vain,” he pointed out.

But certain projects implemented on loans in the past have no use or relevance to the country. For example, the Suriyawewa Sports Complex it has been found, was planned by the Lender himself, including the selection of the location of the playground. Unfortunately, this has become a white elephant and the loan plus the interest accumulated today is around Rs.5 billion.

The Auditor General said, the country must move back to the Permanent Secretaries era where the Minister has no jurisdiction to appoint or dismiss the Ministry Secretary. “To save his ‘seat’ the Chief Accounting Officer obeys every command of the Minister, be it legal or illegal. Their backbones have become non functional,” he said.

He emphasized that according to the present law, the Chief Accounting Officer, ‘the Governor’ in the case of the Central Bank bond issue, cannot hide behind the alleged statement that he was instructed by the Prime Minister. Likewise, in the ‘sil redi’ case during the former regime, the Ministry Secretary cannot wash his hands by saying that the use of state funds for the donation was ordered by the President. “Under the prevailing law both officials are responsible for their acts, whether it was done under influence or not“, he explained.

The same law applies to the construction of the D.A.Rajapaksa memorial. In all these instances, public funds had been misused as if the officials were spending their own money.

No records of the transactions have been maintained.

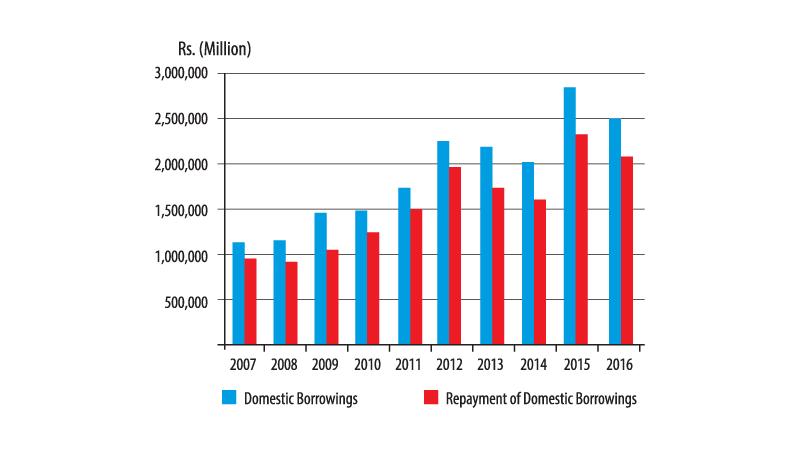

The Auditor General said, the per capita debt burden had drastically increased from December 2005 to 2016 - Rs.108, 000 to Rs.418,000. From December 2015 to December 2016 alone, this increase had been a flat 12%.

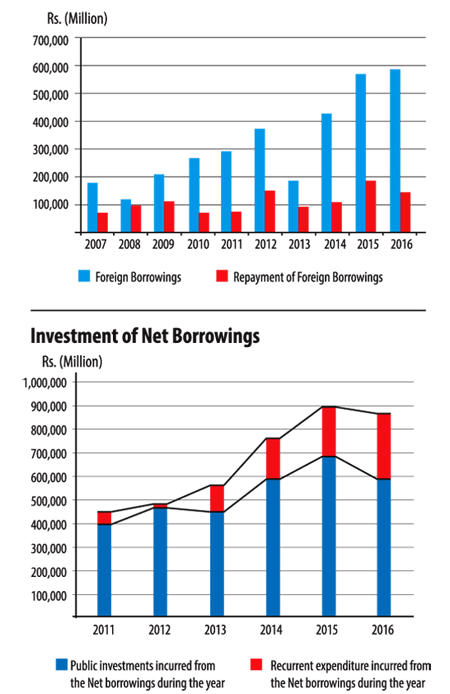

He said, the audits had revealed there is a disturbing trend of exploiting foreign debts on recurrent expenditure, and to bridge the budget deficit. The developing countries use a considerable chunk of loans on recurrent expenditure.

But the gap between the use of loans on capital investments and recurrent expenditure is significantly widening, as observed since 2013.

“So there is a big question mark whether the loans are being used to uplift the living standard of the people,” Wijesinghe said, adding that it was one way state debt can be justified. If not, state debt must help generate state assets or sound investment to generate revenue to repay the loans.

He said, the practice of maintaining a dummy account titled ‘Investment on Borrowings’, to dump unaccounted expenditures, since 2013, was still continuing. In conclusion, the Auditor General had refrained from expressing an audit opinion on the Financial statements of the government for the year ending December 31, 2016 on the principle that he had not received sufficient appropriate audit evidence to provide a basis for the audit opinion.

Unless the government comes up with a strategic plan to repay the accumulated debt and interest, the Auditor General said, the country will be in a very difficult financial footing in the coming years.